China's natural gas power generation is still lagging behind, and foreign enterprises occupy a major share of the market.

Overall, before the start of the "West-to-East Gas Transmission Project" in China, due to the shortage of natural gas resources and the weak foundation of natural gas industry, the development of natural gas power generation was slow and the proportion of power generation was low. Compared with other countries, in 2017, the proportion of generating gas in total natural gas consumption in China is still at a low level, and the gap between China and the United States, Japan, South Korea, Britain and other countries is still large.

Driven by the demand for gas-fired power generation abroad, the gas-fired power generation industry has also developed rapidly, and has formed some leading enterprises in the world. At present, the industry of gas-fired generating units is showing a typical oligopoly competition pattern. The main competitors are Caterpillar (USA), Cummins (USA), Kohler (USA), Wilson (UK), SDMO (France), among which the market share of Caterpillar, Cummins and Kohler is about 63%. The world is in the leading position, accounting for about one third of the global market share.

Although in recent years, many new manufacturers from China and India have been added to the industry, but the engines and generators used by these manufacturers are still mostly international brands, only through localized design advantages and higher cost performance ratio to obtain a certain market share. It can be seen that gas generator manufacturers in Europe, America and other countries are still dominant in the market.

Small-power units dominate sales, but high-power units are the focus of future competition.

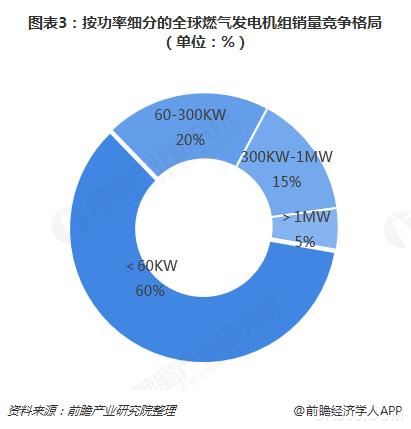

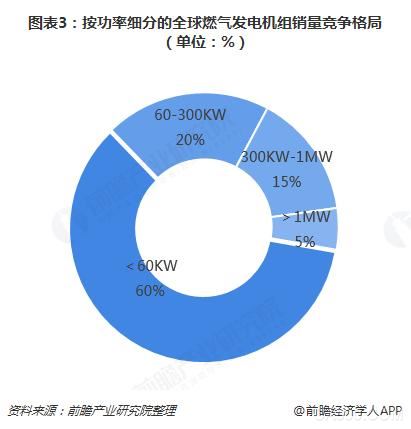

From the power division of gas-fired generating units, it can be divided into four types: less than 60 KW, 60-300 KW, 300 KW-1 MW and higher than 1 MW. Among them, less than 60 KW gas engine units dominate the whole market, accounting for about 60% of the total market sales; while 300 KW-1 MW units account for only 15% of the total sales; gas generator units with power higher than 1 MW account for less. However, the sales contribution of gas-fired generating units with power greater than 300 KW is greater.

In addition, with the increasing demand for 300KW-1MW gas generators from the main power supply in industrial and thermoelectric applications, the demand for high-power gas generators will be increasing in the future. It is estimated that by 2019, the total sales of 300 KW-1 MW and gas-fired generating units above 1 MW will reach about 63%. High-power gas-fired generating units will become the main source of industry revenue, and become the focus of competition among major manufacturers.

Gas Turbine Competition Shocks Great, Will Limit the Development of Gas Generator Industry

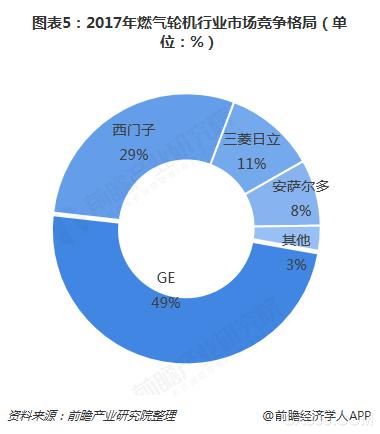

_It is worth mentioning that the current market demand for high-power gas-fired generating units is expanding, which also makes more and more demanders turn their attention to gas turbines with higher output power, which will limit the adoption rate of gas-fired generating units. Moreover, as the scale of gas turbine market continues to shrink, the seller's market competition becomes increasingly fierce. For example, GE's market share in the United States has been eroded by German Siemens, Japan Mitsubishi Hitachi Electric Power and other companies. GE's share in the gas turbine market is expected to fall from 49% last year to about 40% in 2018. The fierce competition in the seller's market will help to improve the bargaining power of downstream buyers, thus reducing the purchase cost of gas-fired power generation equipment.

At the same time, the operation and maintenance costs of gas-fired generating units are relatively high, which also weakens their competitive advantages compared with other generators. This is mainly because the technology development of gas-fired generating units is not yet fully mature, leading to the average cost of gas-fired generating units is still high. According to statistics, the price of gas-fired generating units is nearly 50% higher than that of diesel engines, which greatly weakens the purchasing willingness of the demanders and hinders the development of gas-fired generating units industry. Fortunately, at present, some end-users of gas-fired generating units have begun to pay attention to the overall cost of the equipment during its service life. In the long run, the competitiveness of gas-fired generating units is still strong.

Address:Shan Louli Industrial Zone, Daxi Town, Wenling City, Zhejiang Province

Sales hotline:139 5864 3386

Service hotline:171 5667 1999

Fax:0576-86368833

Tel:0576-86382900

Website:anti-corruption.com.cn

Follow us

Official website